Understanding Common Home Health Care Liabilities

Table of Content

They may hold you responsible for their twisted ankle even if you posted warning signs. Your General Liability policy would pay the client’s medical bills resulting from their injury. As a Home Health Agency, you must also have coverage for claims and accidents that arise from activities and operations that are not related to your professional services. General Liability insurance is your basic insurance coverage and may even be required by a landlord or other business partner.

A civil Assistant U.S. Attorney will review the lawsuit and will conduct an investigation. If the civil AUSA concludes that the lawsuit has merit, then the DOJ will intervene (i.e., take the lawsuit over). At that time, the lawsuit will be “unsealed.” Even if the DOJ does not take the lawsuit over, the relator and his or her attorney can still proceed with the lawsuit. If the civil AUSA believes that the facts are egregious, then the civil AUSA will hand the file to a criminal AUSA who will determine whether or not to bring a separate criminal case against the HHA.

InsureMyRCFE – Your Dependable Liability Insurance Company for Home Care

They often have an auto risk with hired and non-owned insurance as well as employee dishonesty exposures. There is always a possibility that any professional’s work may fail to meet their clients’ expectations, resulting in a professional liability claim or lawsuit. Professional liability insurance is designed to protect the professional from the significant financial loss that can result from a lawsuit. General Liability coverage, also referred to as Commercial General Liability or “slip and fall coverage”, can protect your business against bodily injury or property damage lawsuits from outside parties. Professional Liability insurance can protect professional service providers from potentially devastating financial damages resulting from alleged negligence or error in the delivery of your services. If you get sued, this insurance can pay your legal costs, which includes the cost of an attorney and a settlement if one is awarded.

CM&F’s general liability insurance for home healthcare groups provides coverage for claims of bodily injury as well as property damage that occurs in the facility where services are provided. Additional claims covered by general liability insurance include wrongful eviction, libel, false arrest, advertising injury, as well as malicious prosecution. While there are no mandates surrounding commercial liability insurance, business owners in New York would be wise to invest in this type of coverage. If you are self-employed and employ more than just yourself, please proceed with the group application on this page. If however you do not have any employees, you may apply for individual professional liability insurance coverage – be sure to select “Self Employed” when choosing your employment status. We make it easy to get fast and affordable general liability insurance quotes.

Get an Instant Online Quote from The Hartford

We are working in partnership with Amwins Program Underwriters to create insurance program unique to Home Health Care services. I can't say enough good things about Daniel Santos kind and effective communication skills as an insurance agent. Daniel was so pleasant, friendly and efficient with helping me obtain insurance as a teacher. He made the process easy to understand, it was far easier than what I anticipated.

The agent that I spoke to was very experienced and could tell that I was new at this and was very understanding and took the time to explain everything to me. BizInsure offers Miscellaneous Medical Liability Package designed specifically for Home Health Care Professionals. The package includes General Liability, Professional Liability, and Cyber Liability insurance.

Miscellaneous Medical Liability Package for Home Health Care Provider

Audits are often a game of “gotcha,” in which the payer looks for any reason to recover money previously paid to the HHA. For this reason, it is critical that the HHA implement a robust corporate compliance program that includes 1) conducting self-audits and 2) hiring an outside consultant to periodically come on-site to conduct audits. Most states require commercial auto insurance for vehicles owned by a home healthcare business. It helps cover the cost of an accident involving your business vehicle. General Liability insurance will pay those sums that the insured becomes legally obligated to pay as damages because of bodily injury and property damage to which this insurance applies. We will have the right and duty to defend the insured against any suit seeking those damages.

Gain financial protection and peace of mind knowing you have the right coverage for home care services. In a work environment where the employee is by nature exposed to illness, providing affordable and reasonable health and life insurance is a consideration for all New Jersey healthcare staffers. InsureYourCompany.com can help you choose the best plans for full or partial health insurance, disability insurance and life insurance.

Understanding Common Home Health Care Liabilities

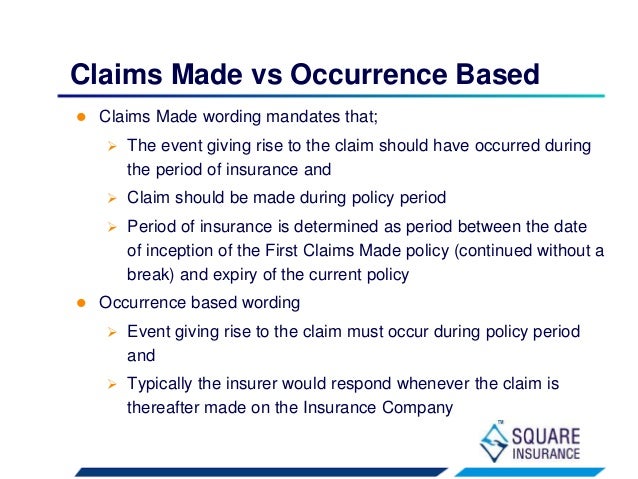

Once you submit your application, you are emailed your coverage documents in minutes – No Delay, No Headache. “Occurrence” or “claims made” refers to the type of policy coverage you’d be purchasing. The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. Some of this material was developed and produced by Agency Revolution to provide information on a topic that may be of interest.

Thimble is a great solution for both general liability insurance and professional liability coverage . Most states require commercial auto insurance for vehicles owned by a home care business. General liability insurance covers basic home health care service risks, such as a client with Alzheimer's slipping and suffering an injury while in your custodial care. Tension runs high when you're taking care of a family's loved one, and accidents can happen even when you provide the best possible care. Home caregiver insurance can help cover costly risks, from client injuries to negligence lawsuits.

A general liability policy covers basic home healthcare risks, such as an elderly patient falling and breaking a hip. Bundle it with property insurance to save in a business owner’s policy. As the owner of a home healthcare agency, you know the challenges of working with a vulnerable population. Business insurance provides financial protection against slip-and-fall injuries, lawsuits, and other risks so that you can continue to provide the best health service possible.

Your Professional Liability coverage protects you from that financial burden. Auto Sales, Service and RepairRead about New York auto sales, service & repair insurance, which provides protection for damages done to customers vehicle's and other property as well as injuries resulting from the work done. As a business owner or small contractor, you require a form of general liability protection, to shield you from such unexpected situations. A single accident might lead into a lawsuit that is beyond your financial abilities. When that happens, you will be staring at losing your source of livelihood.

Our agency specializes in helping business owners find commercial insurance products like general liability, professional liability, property coverage, commercial auto and more. If you own or operate a home care facility and are looking for high quality, affordable liability insurance policies to protect your staff, residents, and operation as a whole, InsureMyRCFE is here to help. With InsureMyRCFE, facilities that meet all of the necessary qualifications can click, quote and bind their insurance policies online with little time and effort required.

This company responded when I needed them to respond while facing a deadline. Had some trouble retrieving my quote to log into my account initially but Daniel assisted me and the changes were made to get me into my account. While you can’t always prevent a cyber-attack from happening, Cyber Liability insurance can help your agency deal with the fallout should one occur.

Insurance for Home Health Care Provider

That is why your business requires general liability insurance protection. General Liability pays losses arising from real or alleged bodily injury, property damage, or personal injury on your business premises or arising from your operations. The Hartford's liability programs extend far beyond the provisions of typical policies, with broadened coverage and increased limits in over 30 areas. General liability insurance for home healthcare clinics is available as an add on to your professional liability insurance policy. Also, landlords & equipment lessors coverage can be added to your general liability insurance policy at no extra cost.

The General Liability policy will not, because no bodily injury was involved. Thousands of professionals have trusted us with their career, and it’s easy to see why. Crime exposure is from employee dishonesty of both money and inventory. Background checks should be conducted on all employees handling money. All ordering, billing and disbursement must be handled by separate individuals.

Comments

Post a Comment